PayPal: A Merger of Enemies That Reshaped Silicon Valley

If you’ve ever networked through LinkedIn, driven in a Tesla, or even watched a YouTube video, you have PayPal to thank. The founders of all these companies got their start when the internet was just taking off, at a fledgling payments startup. PayPal would become a defining tech company, with many of its breakthroughs becoming standard practices for a generation of startups. But these lessons were hard-won in the company’s chaotic start. The PayPal of today only exists because of how its team navigated early crucible moments, including a merger between enemies, a battle against fraud that resulted in security innovations still in use today, and a decision to pursue one of the most significant tech IPOs following the dot-com crash. Explore the inflection points that shaped a cornerstone of Silicon Valley.

Listen Now

Key Lessons

PayPal’s journey from a merger of warring startups to a cornerstone of Silicon Valley is full of lessons for founders. The company’s ability to navigate fierce competition, fraud challenges and existential threats shaped not only its own future but also influenced a generation of tech innovators known as the “PayPal Mafia.”

- Mergers require clear leadership and shared identity. The 50-50 merger between X.com and Confinity created chaos and tension. Max Levchin advises against such arrangements, emphasizing the importance of clear leadership and decision-making authority. When merging, work hard to establish a shared identity and vision before combining forces to avoid prolonged internal conflicts.

- Existential threats can drive innovation. When faced with $10 million in monthly fraud losses, PayPal’s team rallied to create groundbreaking solutions. This “all hands on deck” approach led to innovations like CAPTCHA and micro-deposit verification—technologies still widely used today. Embrace crises as opportunities for creative problem-solving and rapid innovation.

- Balance growth with risk management. PayPal’s rapid growth exposed it to significant fraud risks. Max Levchin suggests that the “lean in, get bruised, but not killed by adversity, figure out how to get out of it, do it again” approach can be a good formula for startups. However, as your company grows, be prepared to evolve your risk management strategies accordingly.

- Cultivate resilience in the face of external threats. PayPal faced constant pressure from eBay, its primary source of transactions. This “sword of Damocles” pushed the team to continually innovate and fight for survival. Build a team culture that can withstand and thrive under pressure from larger competitors or market forces.

- Know when to sell and when to bet on yourself. PayPal navigated multiple acquisition offers from eBay, ultimately going public before selling. This decision allowed them to prove their value in the market and secure a higher acquisition price. Be prepared to make tough decisions about your company’s future, weighing independence against strategic partnerships or acquisitions.

- Don’t underestimate long-term potential. Roelof Botha admits that his biggest career mistakes have been “failures of imagination.” PayPal’s eventual success far exceeded early expectations. When evaluating your startup’s potential, consider Amara’s Law: We tend to overestimate the effect of a technology in the short run and underestimate it in the long run.

- Build a team that can create lasting impact. The “PayPal Mafia” went on to found or invest in numerous successful tech companies. This highlights the importance of assembling a talented team and creating an environment where they can learn, grow and develop skills that extend beyond your current venture.

Inside the Episode

The People

Transcript

Chapters

- The “blood feud” begins: how two warring companies considered joining forces

- Chaos ensues: why Max Levchin now says he would not recommend a 50/50 merger to anyone

- Fighting fraud: How efforts to stanch $10M in monthly fraud and stabilize the business led to an “all hands on deck” innovation sprint

- How Max Levchin thinks startups should balance growth and risk

- The eBay wars: a love-hate relationship escalates

- To IPO, or to capitulate and sell?

- One last offer

- Lessons learned: what to take away from the story of PayPal

Max Levchin: One of the particularly prolific people who was creating these fraudulent accounts on PayPal somehow figured out my email address.

Jimmy Soni: It would be like a bank executive talking to a bank robber as the robbery is happening.

Max Levchin: We went from this is a problem, let’s address it, to this is a survival moment. And if we don’t figure out how to destroy what fraud is doing to us, it will destroy us instead.

Roelof Botha: Welcome to Crucible Moments, a podcast about the critical crossroads and inflection points that shaped some of the world’s most remarkable companies. I’m your host, Roelof Botha.

Your life—or your company—will be disproportionately shaped by a few crucible moments. The decisions you make at these intersections will have an outsized bearing on your journey for years or decades to come.

At Sequoia, we use this as a framework with our founders for navigating decisions—how to identify when you’re facing a crucible moment, and what principles should guide you as you decide your path forward.

Today’s episode is very personal to me. In the spring of 2000, on a student visa from South Africa, and desperate to prove myself and earn a place in Silicon Valley, I joined a fledgling startup called PayPal.

It turned out to be a life-changing crucible moment, but it wasn’t an obvious choice at the time. PayPal as it’s known today—a behemoth with a universal name and logo, one of the highest-valued digital payments companies in the world—is nothing like the company I joined.

On my first day, I walked into a rinky-dink office next to the Palo Alto dump. When I settled into my desk and switched on one of those thick, 1990’s-style desktops, the smell of garbage wafted through the air.

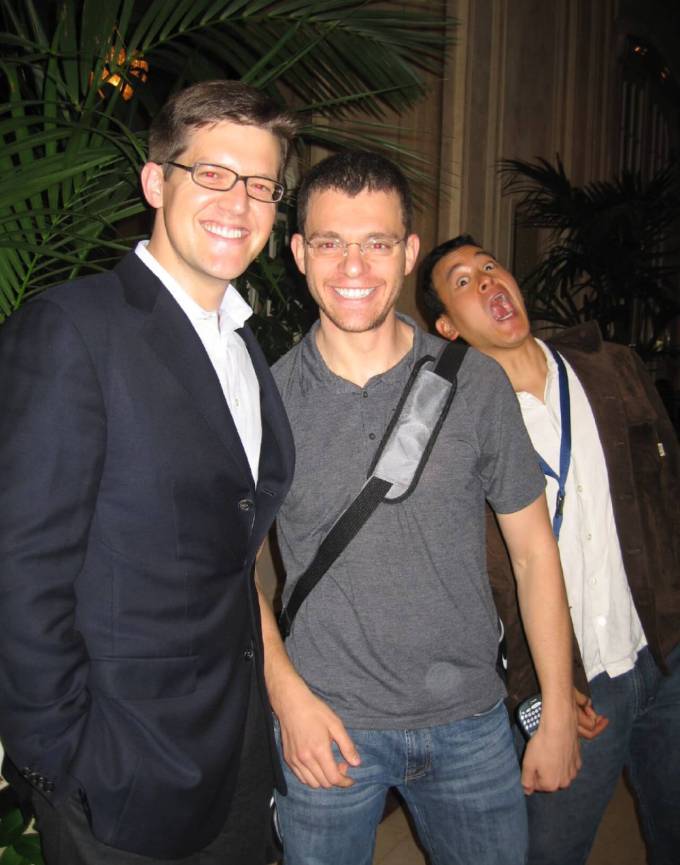

PayPal is also famous for the people who came out of it—Max Levchin who you’ll hear from today, Elon Musk, Reid Hoffman, Peter Thiel, Steve Chen, Chad Hurley—the list goes on and on. They’re often referred to as the “PayPal Mafia” because they went on to found some of the most significant companies of our time. But back then, we were just a group of unknown underdogs working day and night to keep our company alive.

PayPal’s start was a rollercoaster. It was scary. Again and again, we thought the company was going to die. Three defining crucible moments in PayPal’s early history played out nearly simultaneously. Just as we had wrestled one under control, another challenge reared its head.

In this episode, we’ll look at how a 50-50 merger nearly tore PayPal apart, how pressure to stabilize the business led to innovative fraud-fighting measures still in use today, and how a series of acquisition offers tested our team’s resilience and our resolve to fight and bet on ourselves.

You know the PayPal of today. Let’s get into the early days that defined it.

Jimmy Soni: My name is Jimmy Soni. I’m the author of “The Founders: the Story of PayPal and the Entrepreneurs Who Shaped Silicon Valley.”

The “blood feud” begins: how two warring companies considered joining forces

When PayPal was in its infancy, it was two companies. One company was called X.com, and it was founded by a then late 20-something named Elon Musk. The other component of what became what we know as PayPal was called Confinity, and it was co-founded by Peter Thiel and Max Levchin.

Max Levchin: My name is Max Levchin. I co-founded PayPal and was its Chief Technical Officer.

The company was really started around, kind of, this broad idea of cryptography coming to devices with small screens. Of course, this is mid-nineties or late-nineties, and so things like iPhones don’t exist yet, but PalmPilots do. And so you have this—maybe possible—interesting area of opportunity where things like documents and payments will have to be secured. My background was in cryptography. And so I thought of starting a company in the space, met this guy Peter Thiel. We hit it off and co-founded a company that became known as Confinity.

As we sort of meandered through the desert of bad business ideas, we’d realized that nobody actually cared yet about encrypting documents on devices that could barely generate a random number. And so, we sort of chiseled away at it and eventually turned to this idea of payments—initially on your mobile device, but then over time, through sort of a chance migration to the web, basically payments for everyone.

Jimmy Soni: They create an email money framework or a process that we all know as PayPal today.

Roelof Botha: Unfortunately for Max and Peter, they weren’t the only ones working on digitizing payments over the internet.

Jimmy Soni: Elon Musk’s thesis was: If in a digital age money really isn’t real, why does it cost me anything to move money around? If I have an insurance policy and a mortgage and a bank and a brokerage, why can’t that all just live in one place?

And for him, that one place was X.com.

Michael Moritz: We weren’t aware of the presence of Confinity when we made the first investment in X.com.

I’m Michael Moritz.

Roelof Botha: Michael was the Sequoia partner who joined the board of X.com.

Michael Moritz: When we met Elon we didn’t have any background with him. We had not been investors in the first company that he had started, Zip2. So he was fresh and new, and it was obvious that he was one of these characters who was prepared to tilt at windmills, which is the sort of sensibility I think you needed when you were gonna take on the banking establishment.

Jimmy Soni: Here’s what leads to the rivalry between these two companies. Both of them have an email money mechanism, and both of them take off on this corner of the internet called eBay.

So eBay, it’s recently gone public, it’s an auction website, you know, there’s all these buyers and sellers. They could unite somebody that wants to sell a Beanie Baby with somebody that wants to buy a Beanie Baby. And so you have this flea market. But what the flea market hadn’t figured out was how to do the payment part of the transaction.

Roelof Botha: And eBay didn’t have a good integrated payment solution at that time. And so despite the fact that X.com had this broader remit and vision of financial products, it was really their person-to-person payments product that was exploding in use. And similarly with PayPal, it was their email product, again, used by eBay merchants, that was exploding in use.

And the two companies really had neck-and-neck market share on eBay at the time.

Jimmy Soni: They both notice that, like, eBay buyers and sellers are just, like, totally gaga. They’re obsessed. That because it’s an instantaneous money transfer, they don’t have to do things like mail checks or send cash in an envelope or send a, you know, a money order through Western Union. They can just actually, like, send email money.

They both take off. And all of a sudden these two startups that are on the same street—University Avenue in Palo Alto—are competing against each other tooth and nail.

Max Levchin: The actual, sort of, company-to-company relationship was basically that of a mortal enemy, blood feud sort of thing.

Michael Moritz: I always think of the times when Confinity on one side of University Avenue and X.com on the other side were competing as if you’ve ever been to the little Tuscan hill town of San Gimignano, which is dotted in the center by very tall, thin towers where different families lived. And, these towers all have slits in the side for a crossbow and bow and arrows to be shot. These families waged holy war on each other.

Jimmy Soni: And this competition drives both teams utterly, completely crazy, right? You know, the world knows that Elon is no slouch and he wants to win and he wants to be successful. What maybe fewer people understand, but certainly people in Silicon Valley know, is that Max Levchin has just as much endurance and intensity.

There’s a member of the Confinity team that is celebrating a birthday. And the birthday cake is brought out for the Confinity team to enjoy. And on the birthday cake in frosting is, “Die X.com, die.” On the other side of the fence, on the X.com side of the fence, Elon, in a moment of, you know, heated competition, sends an email that, to this day, 20-plus years later, rings in the minds of his teammates. The subject is: “A friendly note about our competitors.” And apparently the text was: “Kill our competitors. Die. Die. Die.” Right?

And so you have this sort of superheated competition. Max Levchin at one point warns his engineers who are working at Confinity to be careful about what they say while walking around Palo Alto because there could be spies everywhere.

Max Levchin: The paranoia took deep hold and in part because we were absolutely certain that they must have heard us through the walls or maybe dumpster dived for our ideas and, et cetera, et cetera.

So it was definitely very, very tense and, and of course, you know, all of us being nerdy engineers, we’d never actually confronted each other in any sort of a physical domain. We just sort of duked it out online.

Roelof Botha: Both X.com and Confinity had very high burn rates. For those folks who are unfamiliar with the terminology in Silicon Valley, the burn rate of a company refers to the rate at which it is depleting its cash balance.

Jimmy Soni: There were people who thought that if the competition continued, that it would be ruinous for both companies. A key person in this process and in the negotiation that followed, and in the kind of armistice that these companies had was Peter Thiel. And he realizes that they are in this fevered competitive environment, but that it is actually costing both companies a huge amount of money and a huge amount of unnecessary stress and grief. That, at some point he realizes that, you know, Elon’s X.com has far more capital than Confinity does. That it could basically just win by dint of size.

Michael Moritz: It gradually became clear as the financing market tightened, that each of these companies, as a separate entity, was treading its own road to perdition. And the sensible thing would be to combine forces.

Roelof Botha: The companies faced a crucible decision: If your business’s life is on the line, do you merge with an enemy? And if you do merge, who’s in charge?

Michael Moritz: Look, there are always two issues that pop up in a merger. One of which is: How much of the cake will my company have? And the second one is: Who’s going to be in charge of the combined entity?

Max Levchin: It was certainly very controversial because the original proposal from X was significantly in their favor. All the metrics suggested that we were in some form or another equal to them. And so my pride was insulted by the original suggestion of, “Let’s do a 90-10 merger in our favor.”

Michael Moritz: There’s nothing complicated about a 90-10 combination. It means that one side has nine slices of the cake and the other side has one slice of the cake. And from Max and Peter’s point of view, I’m sure that they felt that their progress at PayPal and the trajectory they were on should be worth a lot more than just one slice of the cake. And I can well imagine that they were affronted by that. But on the other hand, you have to start somewhere.

Max Levchin: Peter, who’s not a bad poker player himself, I think countered with something like absolutely not.

Chaos ensues: why Max Levchin now says he would not recommend a 50/50 merger to anyone

But I left the negotiation of the actual merger terms to them, which ultimately led to a 50-50 merger. Which is really something I do not recommend to anyone.

Roelof Botha: In early 2000, X.com and Confinity merged. The combined company was renamed PayPal, adopting the name of Confinity’s payments product as the new, overarching name of the company. I joined PayPal on the heels of the merger, which, as Max said, was a 50-50 merger, or a “merger of equals.”

At the time, this was meant to signify that neither team was better than the other. But as Max hinted, the outcome of this crucible moment, a 50-50 split, came at a cost.

Jimmy Soni: When these two companies, X.com and Confinity, unite into one company, it is profoundly awkward. I described the merger of X.com and Confinity as a shotgun wedding, and that’s a pretty apt description given that, you know, just days, just weeks before this merger, these two companies were, like, truly trying to destroy one another.

Max Levchin: Because it was a merger of equals, for example, my position was, “Well, I am the CTO of the combined company. I should be the one making technical decisions.” Of course Elon had his own technical decisions in mind, and there’s well documented rivalry between us about what exactly we should have built and how.

Roelof Botha: So Elon, for example, thought that we should move the infrastructure of the company over to Windows NT and most of the engineering team that had come from the Confinity side were UNIX developers.

And Max also had a very strong point of view that UNIX was a much more secure platform for the company than NT, which I think has proven accurate with the benefit of hindsight.

Max Levchin: That sort of narrative played out in a bunch of other places where you would say, “Well, this is obviously the better way—it was our way.”

And the answer would be, “Well, sure, but we merged 50-50. Like it’s not really clear to anyone here that this was your way or our way.” And so, just creates a set of tensions.

Roelof Botha: Here’s a snapshot of the management roller coaster in those days: Peter was supposed to be the Executive Vice President of the newly combined company. He stepped down in May just six weeks after the merger, but remained on the board. A few weeks later, there was a coup to remove then-CEO Bill Harris. Shortly after that there was another coup to remove Elon Musk—who had replaced Harris—as CEO. And that was in August, while Elon was away on his honeymoon.

The management team drove over to the Sequoia headquarters to plead our case to the board to remove Elon as CEO. We had manila envelopes with signed resignation letters from the management team to show the board that we were serious. I was terrified about what was going to happen—I had no idea how it would unfold.

Michael Moritz: The insurrection, the rebellion, the coup, whatever name you want to associate with it, meant that Peter became the CEO of the business. And Elon, again understandably, was immensely upset about this. I remember him calling me from Australia, obviously deeply upset, wounded, hurt, multiple time zones away, labeling it all a heinous crime.

Roelof Botha: This turnover was all in the span of six months.

Jimmy Soni: What was interesting was listening to employees. One of them actually jokingly said to me, “Sometimes you’d get to the office and you’d be like, ‘Oh new CEO today. All right, no worries. I gotta get back to my work.’ Right?” Because the change was happening that quickly.

And that is actually one of the things that’s remarkable about this story is just the amount, I would say, the sort of toughness of some of the people to get through these record rapid changes, to embrace the fact that immediately after this merger, they have a different title, they have a different role, they don’t know where they’re going to be. And I would say in a lot of cases, the people who impressed me most were people who just said, you know, I’m just gonna do what is needed.

Max Levchin: In retrospect, I think a clear sense for owner versus not, would’ve made it easier for the teams to know who’s the final source of authority. And so having a clear sense for who sets the direction and who leads the company in every part of its operation, in retrospect, is a really, really important thing for all M&A encounters for me.

Michael Moritz: Having clarity about the roles after the merger, having a really good sense of the comparative strengths of individuals in the different companies. And probably most importantly—and this is always absent, doesn’t matter how hard you try—coming up with a shared identity, not separate identities. And if there’s any lesson to be taken away from this merger, it’s to work very hard before you actually combine forces on the identity that together you intend to build. That together you intend to own. And that together you intend to share.

Roelof Botha: As the two teams struggled to get along, the company’s losses were out of control. We had another big problem brewing.

Fighting fraud: How efforts to stanch $10M in monthly fraud and stabilize the business led to an “all hands on deck” innovation sprint

Max Levchin: Right after the merger, the management team started to realize that our fledgling payments businesses, now combined into one, were really getting abused by what the term became known as “the fraudsters”.

Roelof Botha: This summer of 2000 was a very scary time at PayPal. We knew we had a massive fraud problem. It wasn’t obvious that it was solvable.

The primary source of fraud that risked our survival at PayPal was so-called unauthorized fraud. What this meant was a user who didn’t actually have authorization to use a given card would enter that card into PayPal’s system, charge $200 or $300, funnel that money into another account, and maybe consolidate it with a bunch of other accounts that they’d use with stolen credit card information, withdraw that money, and then they’d run off with it. So this was just theft. And so that was the primary source.

And the reason this is a very scary type of fraud is it’s very scalable. You can go to the dark web, so to speak, and you can purchase stolen credit cards for probably less than a dollar today. And you can get a million of them.

And if there’s a way for you to write a computer program to automatically sign up for accounts on PayPal, add credit cards, charge them, funnel that money into a central account, withdraw to a bank account, and run off, you could make off with millions of dollars. And that’s exactly what happened to us.

Jimmy Soni: No one’s ever encountered this kind of thing before, which leaves the company, PayPal, in a very precarious position. It is being defrauded to the tune of over $10 million a month at one point. And it’s also not going to be able to raise more money because venture capital funding in Silicon Valley has all but dried up in the summer of 2000.

Michael Moritz: The tone of the market changed dramatically. Cash became hard and then impossible to raise. And there was money flying out the door because of the cost of fraud.

Max Levchin: It became very clear to all of us that if we were to project fraud losses we would be out of cash and out of business, basically in a few months. And so we sort of went from this is a problem, let’s address it to this is a survival moment. And if we don’t figure out how to destroy what fraud is doing to us, it will destroy us instead.

Roelof Botha: How do you fight fraud and stem losses to stabilize the business? This was PayPal’s next crucible moment, and solving it required all hands on deck. Every engineer was redeployed to fend off the fraudsters.

Jimmy Soni: There is a photo that an employee shared with me and when you look at the photo there’s a, kind of, room. It’s got a glass window on one side and stacked next to this glass window are a whole bunch of cardboard boxes. And then you see something you wouldn’t expect, which is you see a human being sleeping on top of the cardboard boxes. It’s Max Levchin. And he is there catching, you know, precious hours of sleep or minutes of sleep while he is mid all of these fights. He’s amid the fraud fight. He’s amid the growth of the company. And he is sleeping on top of cardboard boxes in the office.

Michael Moritz: Look, in a startup everybody is always burning the midnight hours. And the work intensity of PayPal was immense. For the people involved with PayPal, that was what they lived and breathed 24-hours a day.

Roelof Botha: As PayPal engineers became increasingly immersed in fighting fraud, something strange happened:

Jimmy Soni: The team at PayPal is actually communicating with its fraudsters.

Max Levchin: One of the people who was creating these fraudulent accounts on PayPal somehow figured out my email address and would email me summaries of his takedowns of my latest idea. So before we got to the final version, I would get half a dozen of emails per week from this person somewhere in Eastern Europe saying, “Aha! You try to rename form names in HTML and confuse me. My scripts are not confused. I create 20,000 accounts today.” Sort of menacing emails.

Jimmy Soni: It would be like a bank executive talking to a bank robber as the robbery is happening. Or, or someone breaks into your house and you have a delightful conversation before they steal something from you.

It’s born in part of the background of a group of fraudsters who are based in Russia. And the background of the company CTO, Max Levchin, who was born in Ukraine. And because Max is able to communicate in the fraudster’s native tongue, he is sleuthing. He is visiting the forums where they spend time and share tips about trade craft. He’s in these little chat rooms and kinda, like, picking up intel about PayPal and what people are saying about this company PayPal.

Roelof Botha: Finally, late one night, we had a breakthrough.

Dave Gausebeck: My name is Dave Gausebeck, and I’m one of the creators of the Gausebeck-Levchin Test.

Fighting fraud: How efforts to stanch $10M in monthly fraud and stabilize the business led to an “all hands on deck” innovation sprint

Jimmy Soni: When PayPal was being defrauded in droves, one of the kinds of fraud they faced were from computers, bots, that were basically creating fake accounts by the hundreds so that they could fleece the company for its bonus payments.

Max Levchin: I remember this very, very vividly. I walked out onto the, I was in a cubicle right next to dozens of cubicles of our engineering team. David Gausebeck was, sort of, sitting down writing code. It was late on a Friday night, and I said, “We have all these horrible human beings writing scripts to sign up for PayPal. I want to make them do a puzzle every time they go for a signup, but if you make it too difficult, you will slow down the signups and it would be bad for user conversion or user signups. If you make it too easy, you will automate it or the bad guys will automate it and it wouldn’t work.”

Dave Gausebeck: Thinking back to computer vision classes from college, the idea that I had one night was, well, really let’s just go for any task not related to our site that is easy for humans and hard for computers. And reading text is one of the classic problems for that. And, I thought, well, why don’t we just stick that into our site.

Max Levchin: Gausebeck looked up from his computer and said, “Optical Character Recognition? OCR? A squiggly name is still very easy to read for a human, but computers struggle with OCR.” And that was sort of a holy crap moment. My next move actually was to sprint out to Fry’s Electronics, now sadly departed, where I bought every boxed version of OCR software available in the market to test my squiggly line introduction code to make sure that computers, in fact, could not OCR.

Dave Gausebeck: We figured this will be a new arms race. It’s not an impossible problem to solve, but it makes it a lot harder.

Roelof Botha: If you’ve ever had to look at a series of squiggly letters and retype them to prove that you’re a human, not a robot, you can thank the PayPal team. That’s the Gausebeck-Levchin test, now considered one of the earliest uses and first commercial application of CAPTCHA.

Max Levchin: I stayed up for three days writing code with no sleep, trying to bring it to the site as quickly as possible.

Jimmy Soni: There was a 48-hour coding crazy, you know, caffeine fueled marathon in which David and Max build this technology to defeat these fraudsters. And it is, sort of, happens over a weekend and it is intense. And at the very end of it, when the technology is deployed, a bedraggled Max Levchin takes a big speaker and hooks it up to his computer and he turns on the “Ride of the Valkyries” as a celebratory anthem for having developed this technology and defeated the bots or at least some share of the bots.

Max Levchin: And it had the exact desired effect. The real time account creation fell off by 50%, which we knew half of the accounts were being created were actually fraudulent.

Dave Gausebeck: The easy automated high volume attacks just instantly shut off. And Igor, who had been taunting Max, and sending these emails about how he would always win, and he was smarter than our development team and all of this.

Max Levchin: The moment of extreme triumph for me at the time was when I got an email from him basically saying, “F you.” And I knew it worked because he couldn’t have broken it by then.

Roelof Botha: The PayPal team went on to build pattern recognition tools to identify and stop laundering operations. We developed a system to verify a user’s bank account, to make sure the person who was transferring money in or out was really the owner—another breakthrough invention.

Jimmy Soni: Sanjay Bhargava, who was recruited by Elon to work at X.com, was on a walk with a colleague, Todd Pearson. They were noodling on this problem of how do you verify and authenticate bank accounts. And Sanjay said, “Well, what if we give people two deposits and then it’s a code, it’s a four digit code?”

Max Levchin: So you would have two transfers into your bank account, let’s say for 12 and 35 cents. And then you’d be asked to enter it back in. At the PayPal site, you would basically have to type in 1235. Kind of similar to the four digit pin codes people get all the time now with SMS verification.

Jimmy Soni: The person standing next to him while they’re on this walk for coffee, Todd, looks at Sanjay and says, “You are a genius.” And they get back to the office and they start building that technology right away.

The way that David Sacks, who is the head of product, describes the launch of random deposit. He says, “It’s an idea that’s like Velcro. It’s so good you wish you would’ve thought of it yourself.”

Max Levchin: It’s one or two of many that we had to come up with in a hurry. And without mention go literally hundreds and hundreds of ideas that we had come up with, implemented, only to find out that they didn’t work.

Roelof Botha: With the implementation of these tools, gradually, we saw our efforts to curb fraud pay off. Each month we lost less and less money to fraud. Towards the end of 2000, I thought: You know, we might just make it.

Max Levchin: The bookends of the miracle measure of fraud at PayPal was we were probably over 1% of all transactions processed were fraudulent, which by any measure, in any stretch of imagination, is a horrific number. At the time we went public, I think we were, the gross margin on each transaction was probably 65, 75 basis points or 0.6%. When I was leaving PayPal, the fraud numbers were down to about 19 basis points 0.19%. And, at the time, I thought that was the theoretical minimum. You really could not do any better.

Jimmy Soni: I think one of the more remarkable things about PayPal’s fraud-fighting techniques and tools is that a lot of those tools are still in a wide use 20-years later. And almost nobody recognizes where they originated. And so you have things like random deposit, you have things like CAPTCHA tests that we use at this point unthinkingly. We don’t even consider it. And those all came about in the effort of this one tiny Silicon Valley start-up.

Max Levchin: One of Peter’s favorite expressions is, “This is an experiment you can only run once.”

But it’s very hard to tell whether we could have or should have done anything particularly differently relative to what eventually ended up happening. Maybe if we had pre prevented fraud really successfully from day zero, we wouldn’t have been able to grow as quickly and as well as we did. And so maybe we’re, in fact, better off having gone through this sort of a moment of near death by a thousand paper cuts by these bad fraudsters. Perhaps we could have done better by telling everyone, you know, “We need you to fax us your driver’s license and, you know, show up to our office and login in-person to prove that you are who you say you are.” Really hard to tell.

How Max Levchin thinks startups should balance growth and risk

I think the general pattern of lean in, get bruised, but not killed by adversity, figure out how to get out of it, do it again, is a pretty good formula for startups. I think it becomes harder and harder to do when you have a lot to lose, but we were, at the time, probably still very close to failure in just all kinds of other ways. And the fact that we grew very quickly and we had lots and lots of very happy, legitimate consumers pushed us on to invent a way to remove fraud and fight it. At the time we were celebrating first survival, and then ultimately success.

The eBay wars: a love-hate relationship escalates

Roelof Botha: Throughout 2001, PayPal continued to gain momentum and we gained confidence in the quality of our business. To give you a sense of our growth, we went from roughly $8 million in revenue in Q4 of 2000 to nearly $50 million one year later, while shrinking our fraud loss rate.

But with this growth came friction with eBay. Our presence on the site became a bigger and bigger issue.

Max Levchin: Tension at the PayPal-eBay intersection was that, on the one hand, PayPal was the most popular, fastest growing, most convenient way to pay for purchases on eBay. On the other hand, it was the only part of the eBay experience that eBay didn’t own. They did own a competing product called Billpoint, which they thought should have killed PayPal and made it, or at least made it irrelevant a very long time ago, and yet somehow they failed to do so.

And so, as told from their side or their point of view, PayPal was throwing a party in their backyard and charging attendance and not paying any rent for it. So we were told by their execs time and time again that, “Hey, this will not stand. We’ll eventually build something that competes with you and make you irrelevant.”

Jimmy Soni: Over the course of three years, eBay does everything in its power to gum up the works for PayPal. And PayPal does everything in its power to stay alive on eBay because it’s the place that’s providing at that point, you know, sometimes upwards of 90% of its transaction volume.

eBay would go out of their way to do changes to code on eBay’s website that would make elements of PayPal stop working. And it would send the PayPal team into these kind of, like, paroxysms of, like, action and anger.

Roelof Botha: We knew that eBay had pulled together a war room and that they were trying to figure out how to beat PayPal. They were desperately trying to figure out how to make their own payment system work. I mean, it’s completely rational for them to do that. And at some point they maybe would get it right. And if they did get it right, two-thirds of our business was at risk.

Jimmy Soni: They would send legal notices, they would send menacing emails. They would do code insertions. They would often just cut PayPal out of key product upgrades. There was this kind of sense that there was this big looming existential threat, which was the decision, at any moment, by eBay to shut PayPal down.

Roelof Botha: David Sacks had this phrase, which is, you know, “We went to work every day feeling as though the sword of Damocles was hanging over our head.” And it was a very, very stressful life for us.

Max Levchin: Throughout the time of these sort of eBay wars, their management team would approach us and say, “Look, ultimately you guys understand that we have to come together. You are an essential piece of our puzzle. You also just don’t really exist without us. We are your largest payment platform source. So somewhere, somehow we’re gonna merge. We’re gonna be one company.”

Michael Moritz: We had multiple conversations with eBay which were, you know, conducted with, both a carrot and a stick. The carrot being some sort of acquisition offer, the stick being all sorts of threats about how difficult they were gonna make it for PayPal as a standalone company. How Meg Whitman was gonna ensure that the company, PayPal, was never, ever gonna be able to be a public company because she’d be sure that eBay was writ large in the risk section of the prospectus. And she would ensure that we couldn’t become a public company. And, you know, this went on and—I like Meg and admire her. But, you know, it’s the typical big company posturing, trying to bully and intimidate a small company.

Max Levchin: They would come in and say, “Look, we think we should buy you. Here’s a number.” And the number would inevitably be something that we thought we were worth a year ago. And so it was always, always perceived as kind of an insultingly low offer.

Roelof Botha: We passed on eBay’s offers. And meanwhile, despite Meg’s threats, began to look towards an IPO.

There were a few reasons for this. Going public would provide access to capital, it would legitimize the company, and it would offer us a clear, independent market valuation.

To IPO, or to capitulate and sell?

In September 2001, we filed to go public. That Christmas, just weeks away from our IPO, eBay once again complicated things.

Max Levchin: So eBay came in and said, “Hey, here’s one final offer. We’ll never do any better than this. You guys should not go public. You should sell to us.”

Roelof Botha: eBay’s offer was close to a billion dollars. Their previous offers hadn’t been anywhere close to this, nothing high enough for us to even consider. But this one caught our attention.

Its attractiveness put us at a crossroads, squarely in the middle of a crucible moment. Should we take the offer and end the battle with eBay? Or should we bet on our company’s ability to stand solo, and go public?

Max Levchin: So every time eBay made an offer, one of my kind of standard operating procedures was to sit down with the senior management team and basically say, “Hey, these guys are here. There’s a stack of money on the table. Are you prepared to continue fighting or would you like to sort of punch out and cash in the four years of blood, sweat, and tears?”

And every single time the team basically said, “No, let’s keep fighting.” Like, we can keep doing this. This is actually, some sort of a painful fun that we’re all going through here. It certainly wore the team down in a fairly meaningful way.

Jimmy Soni: There was a pretty vigorous back and forth, a debate among team leadership about what the right thing was to do.

Roelof Botha: To some extent we, as a young team, loved the prospect of being able to take a company public. You know, how many times in your life do you get to be part of building a business from scratch and successfully seeing it through to an IPO? And so there was something alluring about that.

But we also felt a sense of responsibility to our team because you don’t go public for vanity reasons. You wanna do it because you’re a steward of the business and you look after the financial interest of all your shareholders and all the employees.

Peter had this fantastic phrase, which was, “Just because somebody’s shooting at you and they don’t succeed in hitting you doesn’t mean that you’re bulletproof. It may just mean that they’re a poor shot. But if they can keep shooting, at some point even a stray bullet can do serious damage.”

Michael Moritz: Peter was very inclined to make the sale. I did not want to do that. And I think, you know, if Sequoia can claim a contribution to PayPal, it’s that we were able to put off and postpone the sale for as long as possible.

Roelof Botha: PayPal bet on itself. We turned down eBay’s acquisition offer and went public in February of 2002.

There were some who took eBay at its word, that its acquisition offer just before we decided to IPO was its last. And that our battle with them would drag on. Certainly PayPal going public didn’t stop eBay from continuing to make our lives miserable.

One last offer

But then, in the summer of 2002, over the July 4th weekend, eBay approached us again.

Michael Moritz: I remember one weekend afternoon where Peter and I were invited down to Meg’s home in Atherton. And we sat in her kitchen and she was negotiating with us.

Roelof Botha: This time, the offer was $1.5 billion. Now it’s easy for these numbers to seem small as we’re surrounded by today’s tech valuations. But take yourself back 20-years: In 2002, we didn’t have broadband in America. The majority of people on the internet were on dial up. Smartphones didn’t exist. The total number of people on the planet that had access to the internet was about 250 million—not the 4 billion we have today.

This was a tremendous outcome.

Max Levchin: Because the company, PayPal, was public, it was a lot easier for them to understand what the market perceived to be the value of the company. And so as a result, there was no longer this tense and tenuous conversation about price. It was just a matter of, “Well, the public markets are valuing you at X. Here’s what we want to do, and you can decide whether it makes sense to you or not.”

Roelof Botha: Again, we sat down to think things through. Part of this was taking stock of our team and our stamina, and thinking long and hard about what we wanted our future to be.

Max Levchin: And so right after we went public, I had the same conversation with my team and they basically said, “Look, we’re very tired, but we’ll keep fighting.”

And then I, once again, sat down with the management team and said, “Hey, this is a moment to decide.”

Jimmy Soni: What enters into the conversation is, they feel as though they’re simply fighting for their survival and they’re not creating new things anymore. That it gets a little tiresome after a while to simply have to try to stay alive, to like work all night, just so eBay doesn’t shut you down. The team is simply exhausted.

Max Levchin: We’ve checked the checkbox of initial public offering, we’re now a real grownup company. We can keep doing this independently or we can accept the fact that we are ultimately an important tool within eBay, and they are a huge percentage of our ecosystem.

Michael: I had disagreements all the way up to the eventual sale of the business. I thought we had a huge opportunity ahead of us. They were gonna lose control of their destiny. They were gonna be very frustrated. You can live until you’re 120 and you will never see a business opportunity like PayPal. And I was right.

Roelof Botha: We formally announced the acquisition on Monday morning, right after the weekend. And the final acquisition offer was at a $1.5 billion acquisition price, and the acquisition finally closed in October of 2002.

David Gausebeck: It was bittersweet. It was a victory, but it was also being bought by the enemy. It was definitely a step away from being this cohesive team in a smaller office. And it felt like leaving part of PayPal’s history behind.

Roelof Botha: It was very hard to suddenly switch allegiance to this new owner of the business. Peter left. Reid Hoffman left. David Sacks left. And so Max and I were probably two of the last senior management team members left at the company. And, you know, we’d sort of lost the cohesion that we had as a management team, and we were starting to wonder about what we might do next. And at that point, Michael Moritz from Sequoia called and asked whether I’d consider a role at Sequoia. I stayed on through the first earnings release for PayPal in early 2003. And at that point I joined Sequoia.

Lessons learned: what to take away from the story of PayPal

Max Levchin: You know, I think ultimately acquisitions are one of three things.

They’re either exits, or maybe put more bluntly, rescues. And a lot of companies don’t want to admit it to themselves, but they are in need of a rescue. I’m intimately familiar with the hard choice of saying, “I thought this was going to the moon, but it looks like it’ll probably tap out just here on earth.”

The other, more sort of happier, side of M&A is kinda a one-plus-one-equals-five type situations where you really have something and someone else has another building block to what you’re creating. One enables the other.

And there’s a whole sort of a very large component in between where you’ve lost your way and you don’t know what happens next. And you don’t need to die, but you can’t quite figure out how to live, sort of a thing, if a company was a human. And I think those are the hardest ones.

Jimmy Soni: There’s been a great deal written about what’s known as the PayPal Mafia, but maybe what’s more appropriately referred to as the PayPal Alumni Group. An abridged list is almost hard to do, but if you were looking at the creation of YouTube, Yelp, Tesla, SpaceX, Palantir, Affirm, the first money into Facebook, some of the earliest money into every social network you know—all of it traces back to this tiny startup that was created in late 1998 and is sold to eBay in 2002.

There’s always a question of nature versus nurture. Was it just that this company attracted really, really remarkable people who would’ve went on to build YouTube anyway? Or did they take something from their experience at PayPal that helped them build YouTube or Yelp or Yammer or Palantir, et cetera. And I think the honest answer is a bit of both.

They also went through a series of experiences building a startup during one of the hardest times, I think, in Silicon Valley history to ever build a startup. And you couldn’t help but be imprinted by those lessons if you were working there at that time.

Michael Moritz: When they started their respective companies (Yelp, YouTube, some of the others, LinkedIn), they understood they’d already had experience in the setting where they had lived firsthand with the challenges, complexities, opportunities, risks, and excitement of building a very high-growth, successful business.

Roelof Botha: One of the lessons from my PayPal experience is not underestimating what can happen in the long run. One of the things we talk about at Sequoia is what is possible? What is the imagination? And, and honestly, when I think about my biggest mistakes in my professional career, it’s been a failure of imagination. And to see how PayPal flourished in the long run and how successful it’s been, as somebody who was young and didn’t have that much experience, I didn’t fully appreciate the company’s potential.

There’s a famous adage known as Amara’s Law, which states that we tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run. Learning to look at new technologies—whether it’s the internet, cloud, mobile, AI—through the lens of Amara’s Law is part of being a successful founder or investor.

In 2015, PayPal split from eBay, embarking on a brand new chapter for the company, once again, betting on itself. So far it’s paid off. But the story continues.

This has been Crucible Moments, a podcast from Sequoia Capital. Join us next time as we hear from Brian Chesky about how Airbnb built and then had to rebuild user trust, launched a ground war against a clone, and led its community through a global shutdown that brought travel to a halt.