Understanding the Merge

A normie’s guide to one of the biggest changes in Ethereum’s history

The Merge is set to be the biggest crypto event of the year. It’s the first time in history a top market cap cryptocurrency has changed its consensus model and is a key milestone in Ethereum’s long-term scalability roadmap. At Sequoia, we believe in the importance of deeply understanding major events that will be transformative to industries and crypto and the Merge is at the top of this list. As the deadline fast approaches, we’d love to share with the community a summary of our main considerations for the Merge. This is meant to be purely informational, and none of this should be treated as investment advice.

Background

The Merge is the planned upgrade of Ethereum from a Proof-of-Work (PoW) blockchain to a Proof-of-Stake (PoS) blockchain. Proof-of-Stake is a consensus model where network validators —that is, the nodes in the network responsible for maintaining the true transaction history of the Ethereum blockchain—vote on the next “correct” bundle of transactions and are fined if they are bad actors. In contrast, Proof-of-Work is a computational race to decide on the next “correct” bundle of transactions. Instead of being fined, the transactions of bad actors are ignored as the network collectively builds on the “correct” branch.

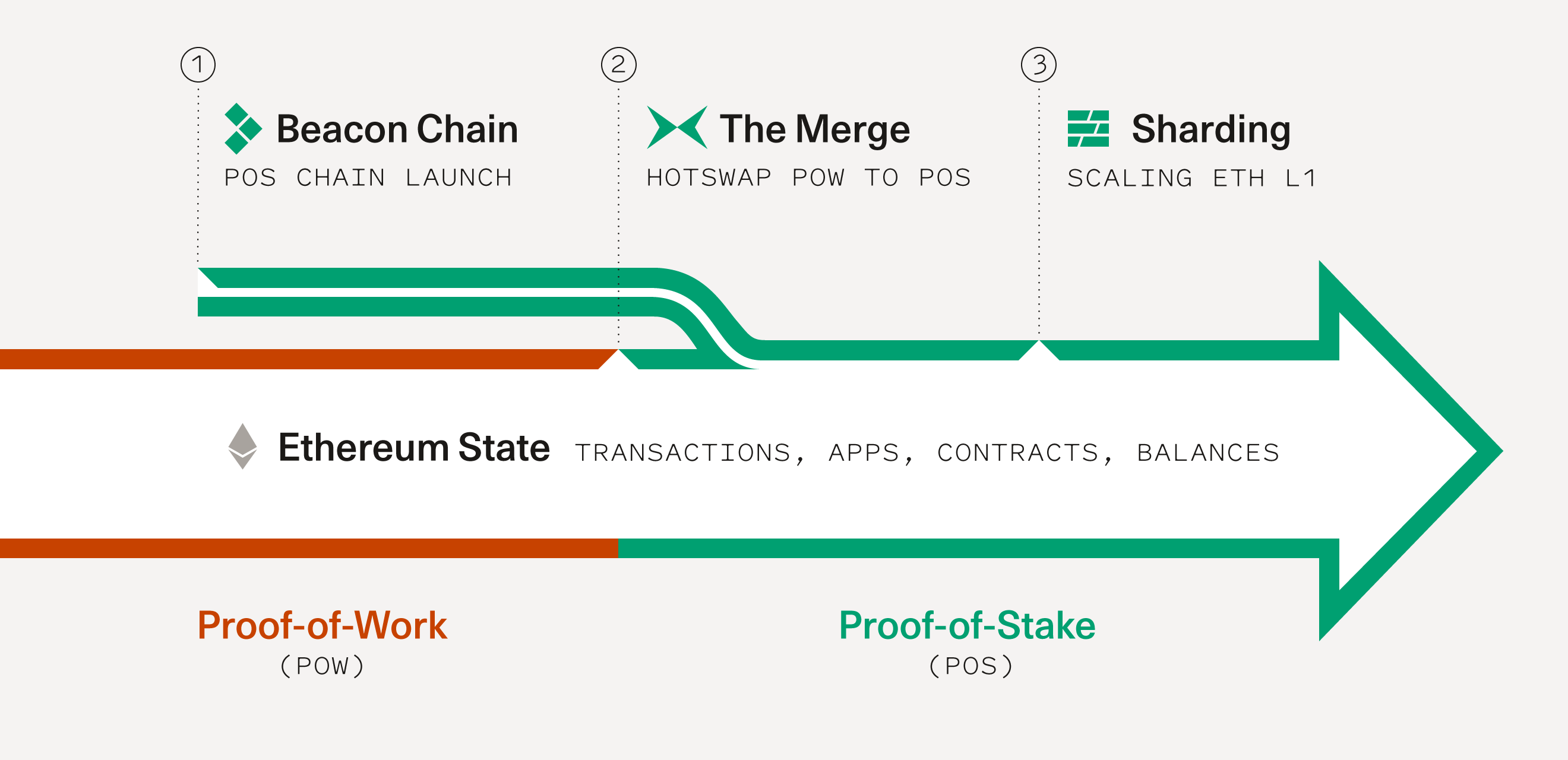

The Merge is an integral precursor to the Ethereum scalability roadmap and has been pushed back many times in the past. As has been repeated ad nauseam, it is important to note that the Merge does NOT scale Ethereum. It merely updates the consensus mechanism to something more akin to other modern blockchains that execute smart contracts. Solana, Avalanche and Cosmos all run PoS-based consensus. Bitcoin, on the other hand, runs PoW consensus. The Merge is a giant step in a three step process to scale Ethereum:

- The first step was the launch of the Beacon Chain in December 2020. The Beacon Chain is a separate PoS-based chain running in parallel with the main PoW Ethereum blockchain.

- The second step is the Merge. This is where we are now! This is the swapping of the main chain for the parallel PoS chain. The estimated date is around September 15 and is dependent on network hashrate.

- The third step is Sharding. You can think of it as Ethereum going multi-threaded to scale the network. The estimated date is 2023-2024, but the community believes it won’t happen until much later due to Ethereum’s track record of significantly delaying both steps 1 and 2 (sorry EF!).

Vitalik estimates the network to be only 55% complete post-Merge, implying that the third and final scaling step will be the largest of the three by far. The price of Ethereum has risen ~60% from July 1 to the time of writing (Sept. 13, 2022). Most of the price increase is attributed to positive sentiment around the Merge as the Merge date approaches. As the Ethereum Foundation loves to point out, if Ethereum is an airplane, it’s like swapping out the engine (or the whole plane) mid-flight. It also changes the economics of all participants in the Ethereum ecosystem. While the first and second order effects have been public knowledge and have been debated in public forums since the beginning of the year, there has been a significant increase in market interest in the past two months as the timeline has been finalized and it is clear that the Merge will indeed happen.

First-order effects

Here are the first-order effects following the Merge, that is, the effects that are a direct consequence of the protocol upgrade:

- Change in security model. Ethereum is moving from a model that is primarily reliant on miners running expensive rigs and performing computation to secure the network to a model reliant on economic voting and “fining” (slashing) to keep voters in check while decreasing energy usage by ~99.95%. Part of the reason the migration has taken so long is that, when it was originally proposed around 2016-2017, PoS was not known to have the same rigorous security guarantees versus PoW, which had been proven to secure a much larger network in Bitcoin. Since then, many other blockchains such as Solana have proven the robustness of PoS consensus in practice and the theoretical robustness is much better understood.

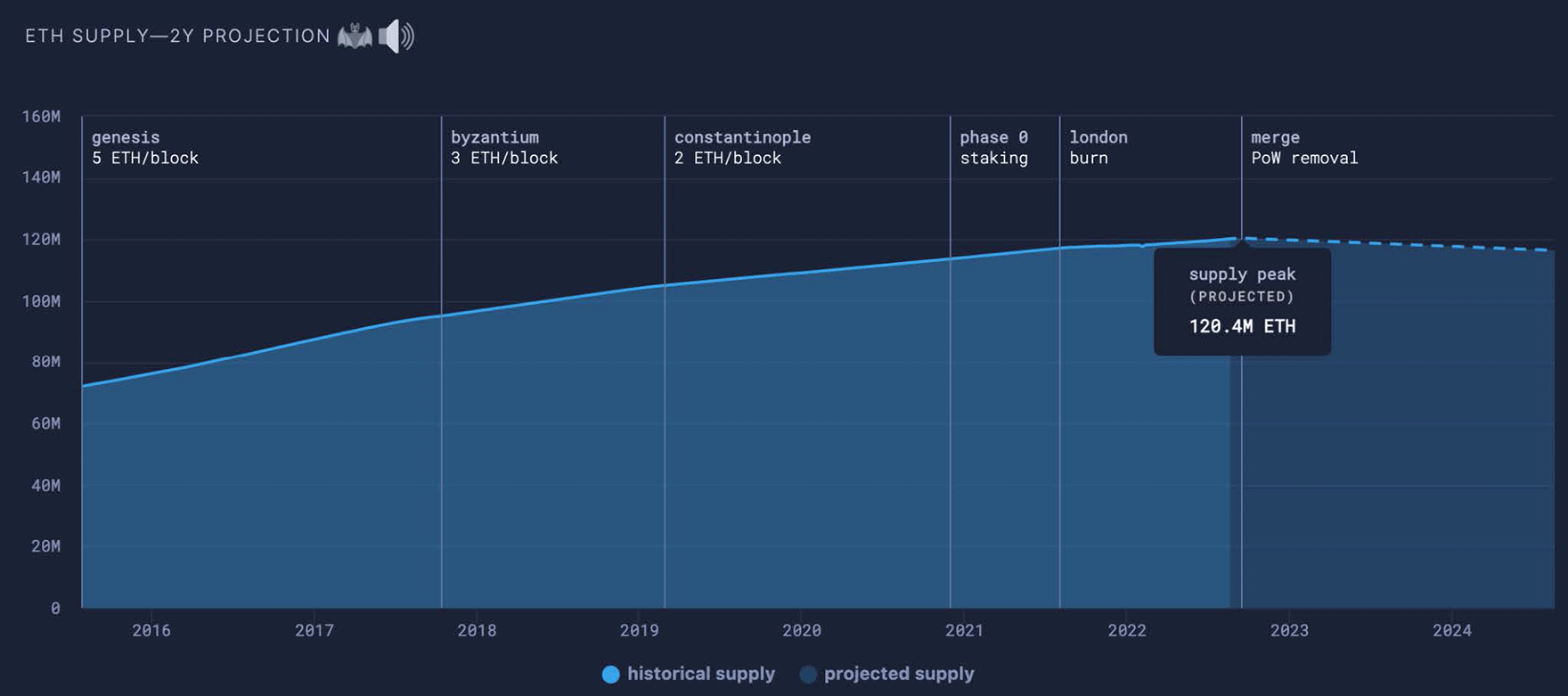

- Decrease in supply and inflation. Ethereum supply will change from ~4.62% inflationary issuance to roughly net zero inflation or potentially slight deflation depending on gas. This is akin to Bitcoin’s halvings but on steroids. The way to think about it is: currently, Ethereum pays ~$26M/day (assuming $2k/ETH)* in rewards to miners to compensate them for running expensive hardware. Afterwards, Ethereum will pay ~$3.2M/day to validators to compensate them for running less expensive hardware. This compensation—called block rewards or validator rewards—happens via Ethereum minting new ETH. After the Merge, the amount of ETH minted will be ~90% less. Plus, there is a countervailing force to the minting of ETH: when paying for computation, a small amount of ETH gets burned (EIP-1559 base fee burns)—that is, removed from the circulating supply. Depending on network demand, this amount just so happens to be roughly equal to the amount that will be paid to validators post-Merge, netting out to roughly zero inflation. There is quite a bit of minutiae, described in more detail here. Net, inflation would drop from ~4.62% to somewhere around 0%, which would correspond to a net decrease in supply of ~4.93M ETH/year (~$9.86B).

- Energy efficiency. The Merge will get rid of PoW as the consensus mechanism for validating the Ethereum blockchain. Energy consumption is expected to reduce by 2000x as hash races are very energy intensive. Total network energy consumption will decrease from ~112TWh/yr to ~0.01TWh/yr. This is comparable from going from the energy consumption of the country of the Netherlands to an energy consumption of ~1000 US homes, which would be a town ~4x smaller than Sausalito. While this will improve the eco-friendliness and brand perception of Ethereum, it should not impact the usability of the blockchain, though it might increase long-term institutional adoption as ESG compliance becomes increasingly important.

- Faster block confirmation times, increased time to finality. Block times will go down from ~13.3s on average to a fixed 12s. This will speed up throughput a little. Finality—basically, settlement time—will increase from around 1.5 minutes to roughly 13 minutes, but with the benefit that finality is now guaranteed (instead of probabilistic, with increasingly high probability over longer periods of time). How this translates to the end user depends more on application developers, many of whom might accelerate time to finality with the tradeoff that they might have to revert the transactions later.

* We’ll assume an ETH price of $2k for the rest of writeup for easy math

Second-order effects

Second-order effects are effects to various ecosystem participants that are a consequence of changes related to the Merge. Here is a non-exhaustive list of second-order effects.

- Increase in staking. As mentioned previously, there are over 400k validators staking ~13M ETH (~$26B) on the Beacon Chain. Their nominal staking yield is ~4% APY, but their real staking yield is ~0% due to ETH inflation mentioned previously. Post-Merge, real yields will match nominal yields as inflation goes to zero. In addition, miners will go away, so the fees they get paid directly to prioritize transactions (called “tips”) will now go to validators. This is expected to increase real staking yields from ~0% pre-Merge to ~7% post-Merge. We expect an immediate increase in staking. If history repeats itself, we will see providers artificially inflate APYs to compete for volume before yields ultimately compress to the ~6-7% steady state. This could play out over several years (remember DeFi summer?). Coinbase has already signaled 9-12% APY, albeit during a time when demand for blockspace was much higher. One more data point to increased staking: Solana, a much more mature staking ecosystem, has staking participation at ~78%. In contrast, ETH Beacon Chain staking is currently at ~11%. Finally, it seems well understood at this point but still worth noting that the ~1M ETH (~$2B) that has been paid out via rewards to validators since the Beacon chain launched December 2020 will be locked for 6-12 months after the Merge, and then will only be “unlocked” at a limited rate. TradFi bros can think of this as a post-IPO lockup period where the staking ETH and ETH rewards cannot be sold.

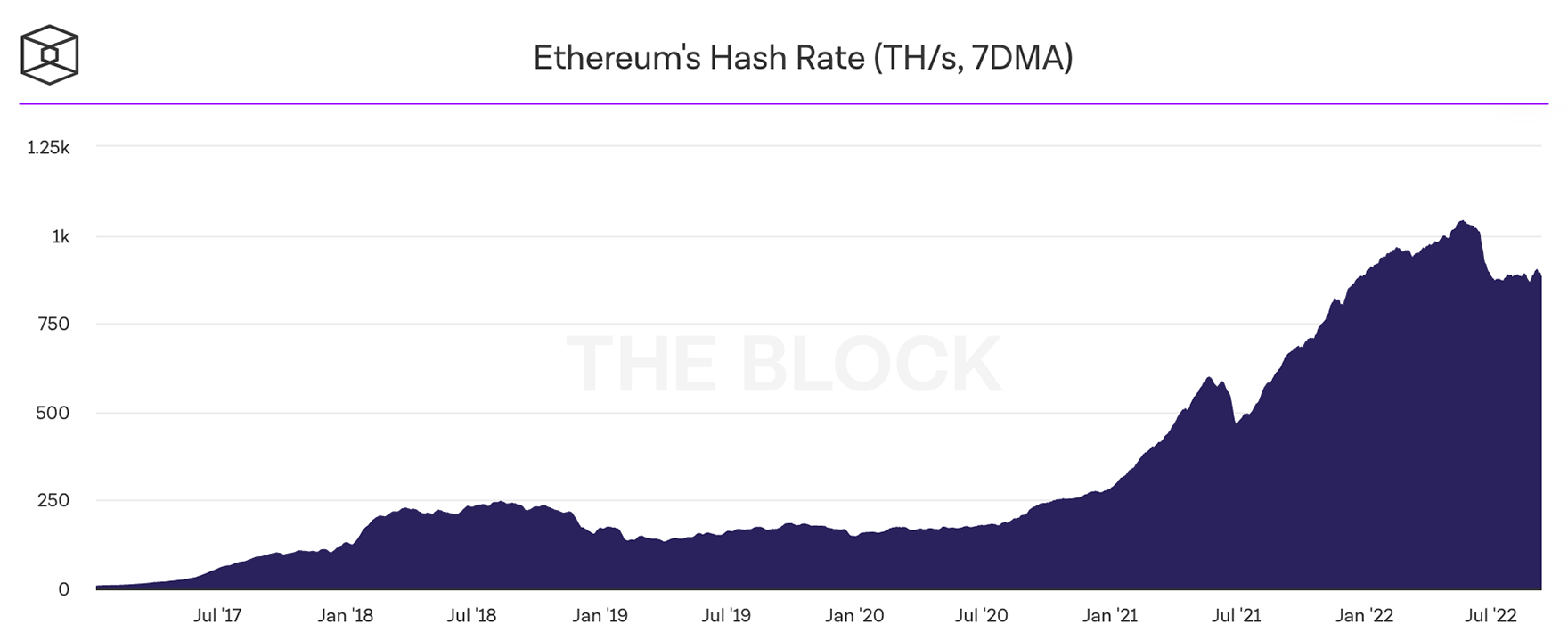

- Miners become obsolete. Ethereum miners generated $19B of revenue from mining rewards in 2021. This will be zero post-Merge. In addition, it is estimated that $5B of hardware is dedicated to ETH mining across GPU miners and ASIC miners, which will need to be repurposed or sold. This is reflected by GPU prices in secondary markets, which decreased 14% in June and 6% in July. Network hashrate peaked in May and saw a notable drop in June. In addition, the reduction of up to ~13k ETH/day of miner sell pressure to cover capex costs in a notoriously low-margin industry, though a small percentage of daily ETH volumes, still changes the supply/demand dynamics.

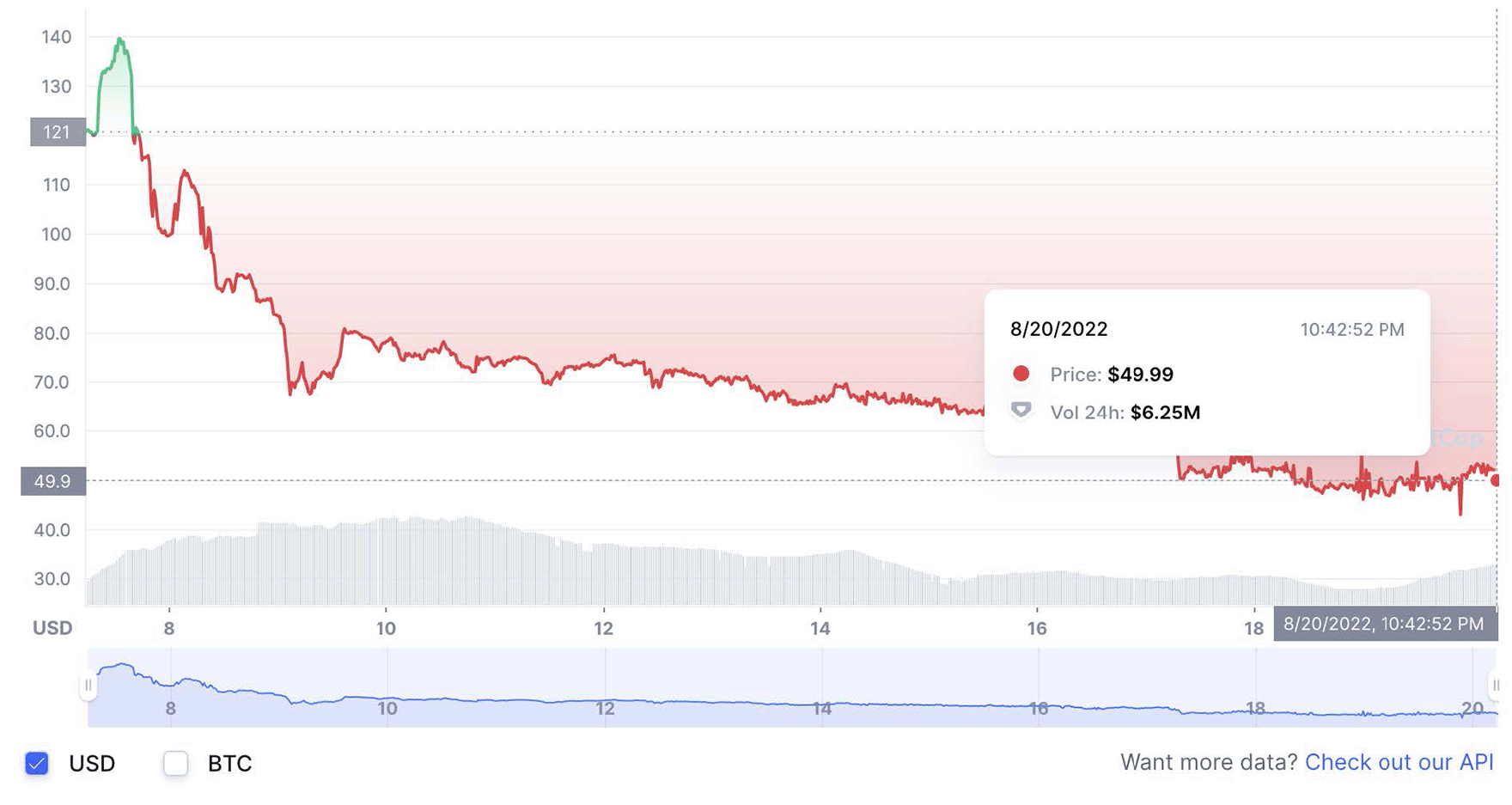

- Contentious hard fork. So where will the miners go? In response to the immediate evaporation of a $18B/yr industry, miners could move to an alternate PoW chain (e.g. ETC) depending on their hardware, or they might organize a revolt. They would continue mining the soon-to-be defunct PoW chain, which would result in a duplication of accounts and transactions histories across the main ETH chain. This would effectively create value as long as key stakeholders—exchanges, infrastructure, and applications—supported both networks. This has happened in a major way twice in the past: once in 2016 when Ethereum forked to ETH and ETC to revert the DAO hack and once in 2017 when Bitcoin forked to BTC and BCH as the community was split over the block size debate. Ultimately, the networks supported by the core developer community won out both times. This time, instead of the dynamic duo of Jihan and Roger Ver, we have Chinese mining kingpin and investor Chandler Guo at the helm. Chainlink, USDC, and USDT have all signaled that they would not support a hard fork as it would have massive negative ramifications: you would immediately duplicate all assets, including NFTs, stablecoins, and wrapped assets. Exchanges all give the boilerplate “we will treat and review this as any other asset” messaging. Compared to previous hard forks, this fork seems to have significantly less community support as virtually every major community figure acknowledges the Merge. Market sentiment reflects this. Justin Sun-backed exchange Poloniex listed an IOU for the forked chain with the ticker symbol ETHW. Since its listing on August 8, it has fallen 64%. The derivatives exchange BitMEX listed a similar perpetuals contract, which followed a similar trajectory (nb: both contracts are thinly traded). The crowded long spot/short futures trade puts the expected value of the forked asset at around ~7% (see next point).

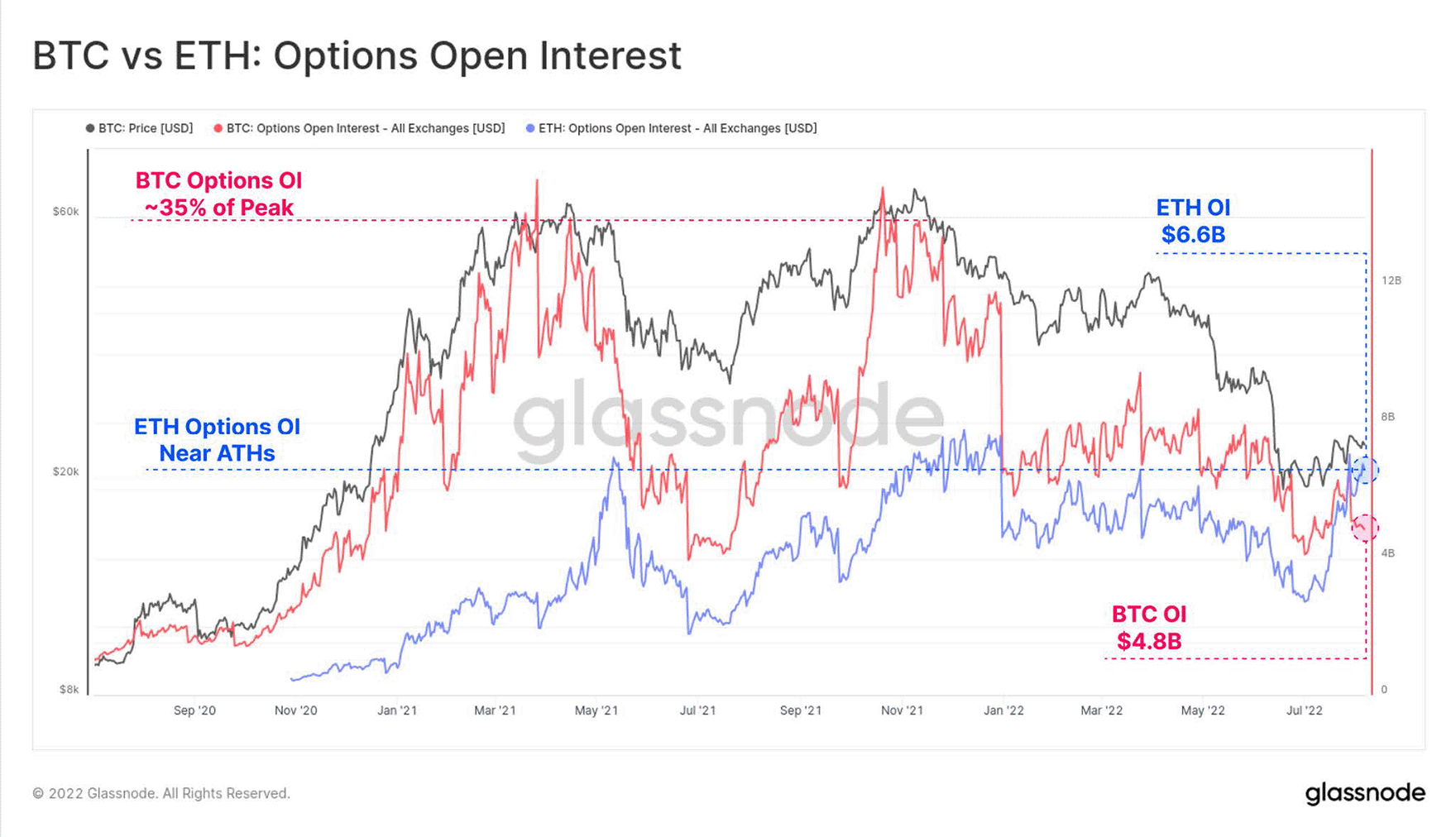

- Increased speculation in perpetuals and futures markets. On August 1, for the first time, open interest on ETH options surpassed BTC options at $5.6B notional vs. $4.3B notional, signaling increased speculation on this singularly important ETH event. In addition, the futures curve started experiencing backwardation (futures prices < spot prices) earlier this month and persists to date. This is significant as your average futures market prices longer term contracts higher (contango). It’s also worth noting that this backwardation only affects ETH: the BTC futures curve is still in contango. The most common interpretation is there is a recent increase in demand as institutional investors go long ETH hedged by short futures, netting free forked PoW ETH.

- Other considerations. There will be new opportunities in MEV (maximal extractible value) as block proposers are now known in advance. Our rudimentary guess is that MEV will increase in the short term as new areas of MEV are figured out and PBS (proposer builder separation) works towards getting adopted, but might decrease in the long run post-PBS implementation and adoption of mev-boost. Other areas of technical or tail risk are likely overestimated as the Ethereum Foundation has committed to a TTD (terminal total difficulty), though we are reliant on developers to perform some updates on their dApps. Finally, mainstream media coverage and general hype has picked up in the weeks preceding the Merge, and we can only expect this to increase and amplify the success or hiccups (if any) immediately following.

Short-Term

In the days immediately leading up to and following the Merge, we might see a lot of volatility as the market prepares for a rate hike following the September 13th CPI update. In addition, macro uncertainties around European oil prices, a potential re-escalation in Ukraine, China/Taiwan black swan events, domestic inflation concerns over student loan cancellations (though it will likely play out over a longer period of time) could be strong factors to the extent crypto blue chips become increasingly more correlated with the S&P and global markets. There is a minimal chance that the Merge is a catastrophic failure—I’ve heard anywhere from 0.1% to 5%—and institutions seem to be pricing in this tail risk. If you were to decompose ETH/USD to ETH/BTC and BTC/USD components, there is a possibility that the BTC/USD side dominates in the near term. A hard fork might result in a rush to the exits similar to the ICO/IEO days as soon as there is a venue for PoW ETH liquidity; however, the long-term impact on the ecosystem will likely be negligible.

Medium-Term

Over a longer period of time, say 6-18 months, we expect the positive supply changes and the positive economics of staking versus mining to dominate. The shift of Ethereum from an inflationary currency to a potentially deflationary currency introduces supply reductions similar in structure to Bitcoin halvenings. And the shift of network participants from miners to validators reduces sell pressure in perpetuity and effectively decreases circulating supply. If you think of it from naive Econ 101 terms, the supply curve shifts aggressively left while the (unpredictable) demand curve should generally move right as staking demand increases.

Long-Term

Long term is anyone’s guess. Most importantly, after the Merge, Ethereum will have proven the ability to execute on their ambitious roadmap of Ethereum scalability. There are more upcoming structural changes to be aware of, notably the Shanghai upgrade where Beacon chain ETH will be unlocked, sharding and Verkle proof compressions. This is a strong signal to developers, especially new ones, and a good signal for the Ethereum community overall following the surge of alt L1 developer momentum towards the end of 2021. We don’t have strong opinions on the long term viability of individual ecosystems, though we acknowledge the underlying thesis of scaling at the base layer has its merits and will be eagerly tracking the progress of Solana, Cosmos appchains, Sui, Aptos and others as they launch and gain more adoption. In all of this, Bitcoin seems a little underappreciated since maximalism and perhaps a bit of hubris have isolated the community from broader crypto discourse. However, Bitcoin is and will continue to be Bitcoin—the most viable digital gold—and we will watch with interest as Lightning, Lightspark and Stacks, among others, work to push the narrative of a global state-free currency and programmable money.

Thanks to Joey Krug, Larry Cermak, Chris Chang and Shaun Maguire for your detailed feedback and suggestions.

Disclaimer

The information contained here has been prepared by Sequoia Capital Operations, LLC (“Sequoia”) for informational purposes, and it is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Sequoia or any other Sequoia entity. The information is given in summary form and does not purport to be complete. Please also note that the performance information included herein does not reflect performance as a whole of funds managed by Sequoia.

Past performance is not indicative of future results. All forward-looking statements are based upon assumptions that may not prove to be correct and actual future operations, opportunities, or financial performance may differ materially from these forward-looking statements. There is no obligation for Sequoia to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise.