Partnering with Tola: Cash-Flow Management for Small Businesses

Alen, Guillaume and their team created an all-in-one platform to help entrepreneurs pay bills—and get paid—on their own terms.

Can we afford to grow the team? Is it time to expand our product line? When should we open a second location? Small business owners struggle to make countless everyday—but high-stakes—decisions not because their businesses are flawed, but simply because of their scale.

While large companies with large cash positions can often weather the storms of the open market, unexpected adverse events have an outsized effect on small businesses. And even more stressful for these entrepreneurs is that many are flying blind, with little to no month to month insight into their cash flow. Their working capital is defined by how quickly they can receive payments from customers, and how long they can defer their own—yet in the United States, many B2B payments are still made manually, by paper check. Owners waiting on funds are paralyzed by uncertainty, and only a third of them survive 10 years, with cash flow problems blamed for the vast majority of failures.

Most small businesses don’t have a CFO or finance manager who can focus on these problems full-time. But what they do have, now, is Tola.

Tola co-founders Alen Cvisic and Guillaume Simard understand firsthand the challenges facing their customers. As the first and sixth employees at the European expense management giant Pleo, they served thousands of small businesses, and recognized that managing cash flow was by far the biggest pain point. They designed Tola to give entrepreneurs a consolidated, easy-to-use tool for managing their finances—and to give them full control over how and when payments happen.

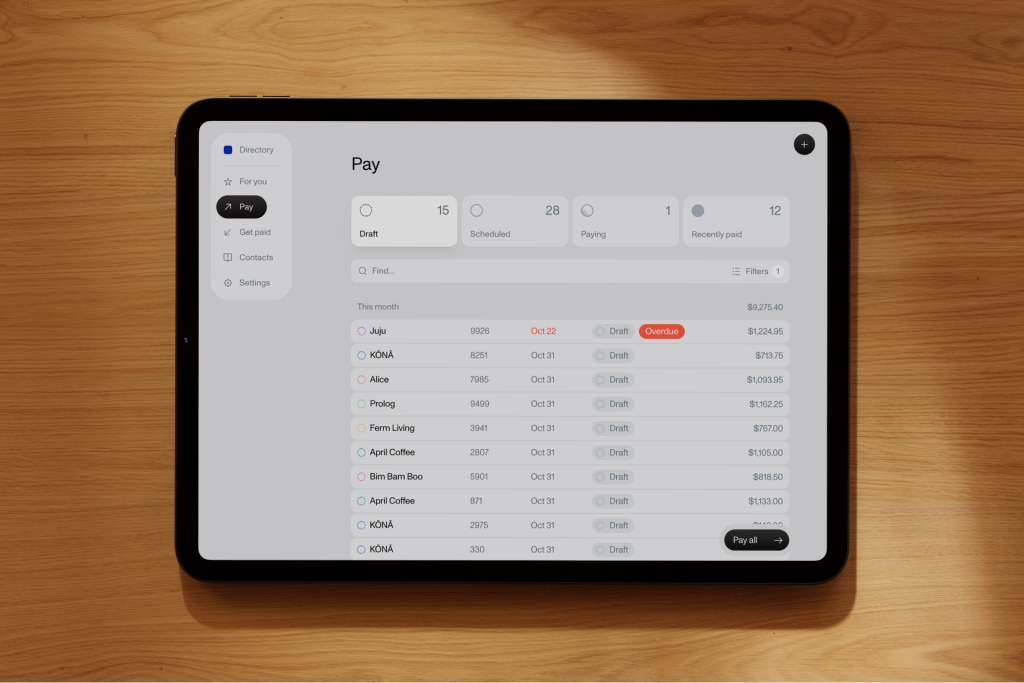

Tola empowers you to choose your method of paying and getting paid (credit card, ACH, wire) as well as the timing, with 30- to 90-day “pay later” options accessible with a single click. Tola pays your supplier instantly, but you pay on your own terms. The platform also allows you to manage accounts payable and receivables in one place, integrating with your accounting software and bank to give you a clear, complete picture of your finances—and save time and money in the process.

We knew Alen by his reputation at Pleo, and in 2022 invited him to become a Sequoia Scout. As he and Guillaume developed their founding vision, we stayed in touch, and are proud to be early partners leading their seed round. They have gathered around them an elite team of world-class builders—many of whom are experienced founders themselves—and have impressed us with their ability to balance quality and speed. Distributed across the Americas and Europe, the team comes together regularly for in-person hackathons they call “Tolapaloozas,” which consistently lead to high-velocity development and a delightful, beautifully clean product that’s perfect for the small business owners they serve.

Importantly, Alen, Guillaume and their team are experts not just at building Tola, but at selling it, as well. They recognize that most small business owners lack cash-flow software not because they’re uninterested, but because no one’s telling them about it; the difficulty and expense of finding customers in this massive, highly fragmented market scares off most would-be providers. Alen and Guillaume are different. They built an incredible product-led growth motion at Pleo, and are now leveraging those learnings in the U.S., where more than 33 million companies need their help.

Already, thousands of those businesses have signed up for early access to Tola, which is now processing millions in payments every month. With this round of funding, Alen, Guillaume and their team are ready to accelerate and scale, growing both their customer base and their product. We at Sequoia believe strongly in their mission and are excited to see Tola give small business owners more time, more control, more peace of mind—and more opportunities to build a better future for us all.